tax shelter meaning in real estate

Delving into this a little further a tax shelter isnt too far off the first definitions mark while having nothing to do with the second. View the definition of Tax Shelter and preview the CENTURY 21 glossary of popular real estate terminology to help along your buying or selling process.

ˈshel-tər Used in a Sentence.

. Ee the current RET rates across the country. A term used to describe some tax advantages of owning real property or other investments. Several estate tax shelters exist.

There will be a penalty of 1 of the total investment if not registered for a tax shelter. RETs can include exemptions for certain types of buyers based on buying status or income level. A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to limited partners or limited entrepreneurs.

An investment is a tax shelter when it shields income or gain from payment of income taxes. However its not a permanent one. There wont always be significant real estate investment tax shelter benefits when you are flipping a house because odds are you sell the property within a year of purchasing but every little bit helps.

Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs. If you carry a mortgage on your rental property you can deduct mortgage interest paid come tax time. Several estate tax shelters exist.

An establishment that houses and feeds strays or unwanted animals. A tax shelter is a method used by businesses and individuals to reduce their tax liabilities. By definition tax shelters are methods which help you reduce your tax bill.

So a real estate tax shelter is a good option if you want to invest and reduce your taxable income at the same time. Before we dive into all the important reasons why tax shelter is something you should be knowledgeable about its best to get this burning question out of the way yes tax shelters are legal. The tax shelter portion of home equity occurs in the event that the individual at some point decides to sell their home.

Failure to report the tax shelter identification number will result in a penalty of 250. Under section 448 d 3 a taxpayer that is a syndicate is considered a tax shelter. 448a3 prohibition defines tax shelter at Sec.

Something that provides protection. 461i3 provides that the term tax shelter. The most common tax shelter is through such retirement accounts.

WHAT IS A REAL ESTATE TAX. Tax Shelter Law and Legal Definition. Think of tax shelters as your financial bottom lines best friend.

A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. A tax shelter is any legal strategy you employ to reduce the amount of income taxes you owe.

448d3 which states that the term tax shelter has the meaning given such term by section 461i3 Sec. An investment that shields items of income or gain from payment of income taxes. The IRS allows some tax shelters but will not allow a shelter which is abusive.

Tax shelter has the advantage because taxpayers have a high tax bracket so they can suffer losses from it to reduce taxable income. For purposes of section 448 d 3 a syndicate is a partnership or other entity other than a C corporation if more than 35 percent of the losses of such entity during the tax year are allocated to limited partners or limited entrepreneurs. A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to limited partners or limited entrepreneurs.

Tax shelters work by reducing your taxable income thereby reducing your taxes. Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to anotherSt ates counties or municipalities can impose RETs. The Internal Revenue Service IRS offers individuals a capital gains tax exemption on the first 250000 from the sale of their home.

A 401k account is a tax shelter. Failure to report the tax shelter identification number will result in a penalty of 250.

Statement Of Cash Flows Indirect Accounting Cpa Exam Cash Flow

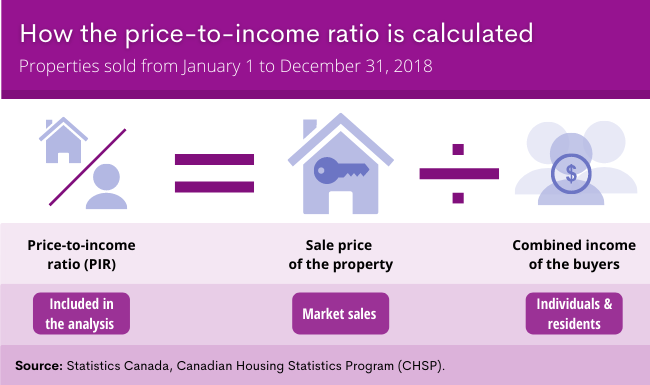

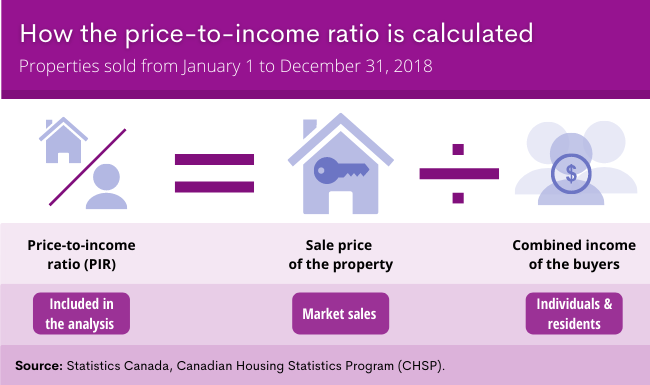

Residential Real Estate Sales In 2018 The Relationship Between House Prices And Incomes

Tax Shelters For High W 2 Income Every Doctor Must Read This

Pin On Ap Gov Bill Of Rights Project

Housing Prices Index Up 3 9 In Q4 Of 2019 20 On An Annual Basis Rbi House Prices Growth Strategy Recruitment Plan

What Is A Credit Shelter Trust Our Deer Estate Law Estate Planning Estate Tax

Identifying A Gordon Van Tine Kit Home Vintage House Plans Kit Homes American Four Square House

Tax Shelters Definition Types Examples Of Tax Shelter

Why The First Multi Family You Buy Is So Important Residential Real Estate Real Estate Investment Property

The Insurance Lady Insurance Marketing Gift Mouse Pad Zazzle Marketing Gift Life Insurance Quotes Insurance Marketing

How Is A Tax Shelter Calculated In Real Estate

Fipedia Financial Independence Early Retirement Investing

Income Tax Calculation For Professional Cricketer 1 5 Cr Husband And Wife Income Tax Budgeting Income

Hướng Dẫn Khach Hang Ca Nhan Lam Hồ Sơ Vay Vốn Ngan Hang Loan Lenders Hard Money Lenders Loans For Bad Credit

Preparing Your Community For Opportunity Zones Opportunity Capital Gain Track Investments

How The Broad Definition Of Tax Shelter Affects Business Interest Deductions And Cash Method Accounting Under New Tax Law Article Refinancing Mortgage Letter Gifts Mortgage Rates Today

Check Out Our Winter Storm Safety Tips And Keep Your Family Safe During The Blizzard Join Us On Twitter At Winter Storm Preparedness Safety Tips Winter Storm